Repsol (BME:REP) Is Paying Out A Bigger Dividend Than Final Yr

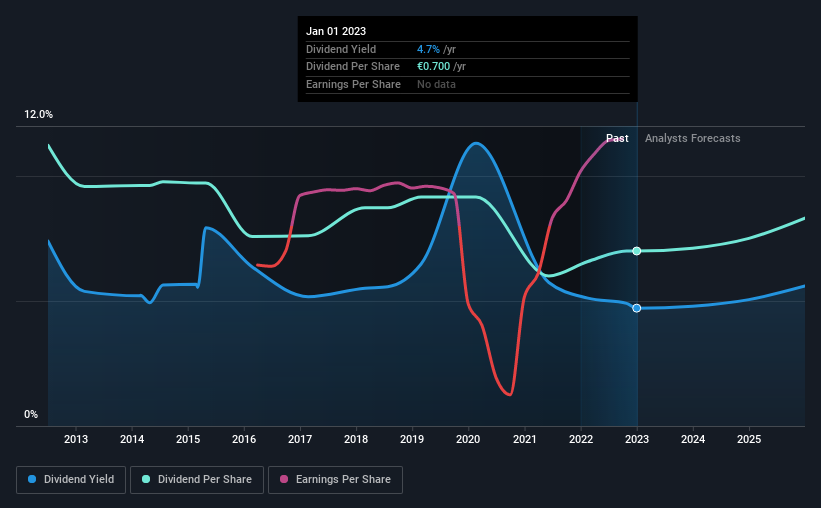

Repsol, S.A.’s (BME:REP) dividend will probably be rising from final yr’s cost of the identical interval to €0.2835 on eleventh of January. This takes the annual cost to 4.7% of the present inventory worth, which is about common for the business.

See our newest evaluation for Repsol

Repsol’s Earnings Simply Cowl The Distributions

Whereas it’s at all times good to see a strong dividend yield, we must also think about whether or not the cost is possible. Earlier than making this announcement, Repsol was simply incomes sufficient to cowl the dividend. Because of this most of its earnings are being retained to develop the enterprise.

Over the following yr, EPS is forecast to broaden by 5.2%. If the dividend continues alongside latest traits, we estimate the payout ratio will probably be 19%, which is within the vary that makes us comfy with the sustainability of the dividend.

Dividend Volatility

Whereas the corporate has been paying a dividend for a very long time, it has reduce the dividend a minimum of as soon as within the final 10 years. Since 2013, the annual cost again then was €1.12, in comparison with the newest full-year cost of €0.70. This works out to be a decline of roughly 4.6% per yr over that point. Declining dividends is not usually what we search for as they will point out that the corporate is working into some challenges.

The Dividend Appears Seemingly To Develop

Rising earnings per share may very well be a mitigating issue when contemplating the previous fluctuations within the dividend. Repsol has impressed us by rising EPS at 20% per yr over the previous 5 years. Earnings per share is rising at a strong clip, and the payout ratio is low which we predict is a perfect mixture in a dividend inventory as the corporate can fairly simply elevate the dividend sooner or later.

Repsol Appears Like A Nice Dividend Inventory

General, a dividend improve is at all times good, and we predict that Repsol is a robust revenue inventory because of its monitor report and rising earnings. Earnings are simply overlaying distributions, and the corporate is producing loads of money. All in all, this checks lots of the containers we search for when selecting an revenue inventory.

It is necessary to notice that firms having a constant dividend coverage will generate higher investor confidence than these having an erratic one. Nonetheless, buyers want to think about a bunch of different elements, aside from dividend funds, when analysing an organization. Working example: We have noticed 3 warning indicators for Repsol (of which 1 makes us a bit uncomfortable!) it is best to learn about. Is Repsol not fairly the chance you have been on the lookout for? Why not take a look at our number of prime dividend shares.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Repsol is doubtlessly over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved concerning the content material? Get in contact with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We intention to convey you long-term centered evaluation pushed by basic information. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MC323WHKGVMYLLRLHIAGBGIQHE.jpg)