Do not Ignore The Insider Promoting In Ameren

Some Ameren Company (NYSE:AEE) shareholders could also be somewhat involved to see that the Government Chairman, Warner Baxter, lately bought a considerable US$4.5m value of inventory at a value of US$90.32 per share. That is a giant disposal, and it decreased their holding measurement by 21%, which is notable however not too unhealthy.

See our newest evaluation for Ameren

The Final 12 Months Of Insider Transactions At Ameren

In truth, the latest sale by Government Chairman Warner Baxter was not their solely sale of Ameren shares this 12 months. Earlier within the 12 months, they fetched US$93.44 per share in a -US$5.0m sale. That implies that an insider was promoting shares at across the present value of US$87.73. We usually do not prefer to see insider promoting, however the decrease the sale value, the extra it considerations us. On this case, the massive sale came about at across the present value, so it isn’t too unhealthy (nevertheless it’s nonetheless not a optimistic).

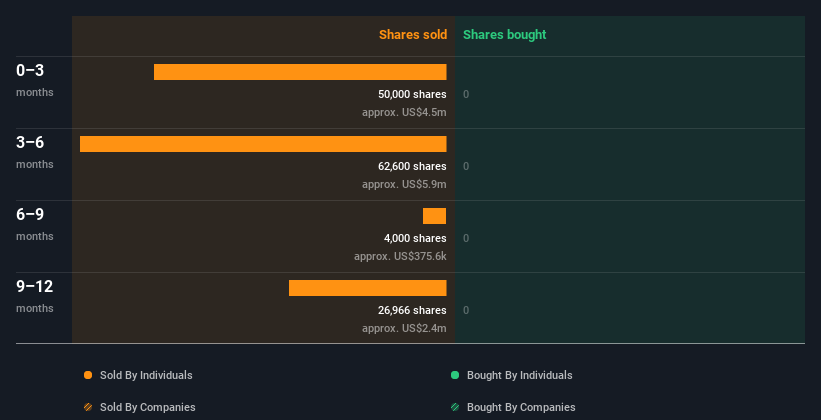

Insiders in Ameren did not purchase any shares within the final 12 months. You may see a visible depiction of insider transactions (by firms and people) over the past 12 months, under. Should you click on on the chart, you possibly can see all the person transactions, together with the share value, particular person, and the date!

For individuals who like to search out successful investments this free checklist of rising firms with latest insider buying, might be simply the ticket.

Insider Possession Of Ameren

One other strategy to check the alignment between the leaders of an organization and different shareholders is to take a look at what number of shares they personal. I reckon it is a good signal if insiders personal a big variety of shares within the firm. Ameren insiders personal 0.4% of the corporate, presently value about US$101m based mostly on the latest share value. Most shareholders could be comfortable to see this form of insider possession, because it means that administration incentives are properly aligned with different shareholders.

So What Does This Information Recommend About Ameren Insiders?

An insider bought inventory lately, however they have not been shopping for. Seeking to the final twelve months, our information would not present any insider shopping for. On the plus aspect, Ameren makes cash, and is rising earnings. The corporate boasts excessive insider possession, however we’re somewhat hesitant, given the historical past of share gross sales. Whereas we like realizing what is going on on with the insider’s possession and transactions, we ensure that to additionally contemplate what dangers are dealing with a inventory earlier than making any funding resolution. After we did our analysis, we discovered 3 warning indicators for Ameren (1 is regarding!) that we imagine deserve your full consideration.

In fact, you may discover a incredible funding by wanting elsewhere. So take a peek at this free checklist of attention-grabbing firms.

For the needs of this text, insiders are these people who report their transactions to the related regulatory physique. We presently account for open market transactions and personal inclinations, however not spinoff transactions.

What are the dangers and alternatives for Ameren?

Ameren Company, along with its subsidiaries, operates as a public utility holding firm in the US.

Rewards

-

Earnings are forecast to develop 8.63% per 12 months

-

Earnings have grown 11.1% per 12 months over the previous 5 years

Dangers

-

Debt isn’t properly lined by working money movement

-

Important insider promoting over the previous 3 months

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We purpose to deliver you long-term targeted evaluation pushed by elementary information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

/cloudfront-us-east-1.images.arcpublishing.com/gray/H6DBT2QF35FSBMYPELPT6CA46U.bmp)