Repsol Considers Reviving LNG Export Undertaking from Atlantic Canada’s Canaport Terminal

A number of years after the proposal was shelved, Repsol SA might revive a plan to export pure gasoline from its Atlantic Canada LNG import terminal.

The Spanish-based power main’s govt group mentioned the potential to maneuver liquefied pure gasoline (LNG) from Atlantic Canada to abroad markets in the course of the second quarter earnings name.

“We have now met authorities on that…in some European international locations,” together with Germany, Investor Relations chief Ramon Alvarez-Pedrosa advised analysts.

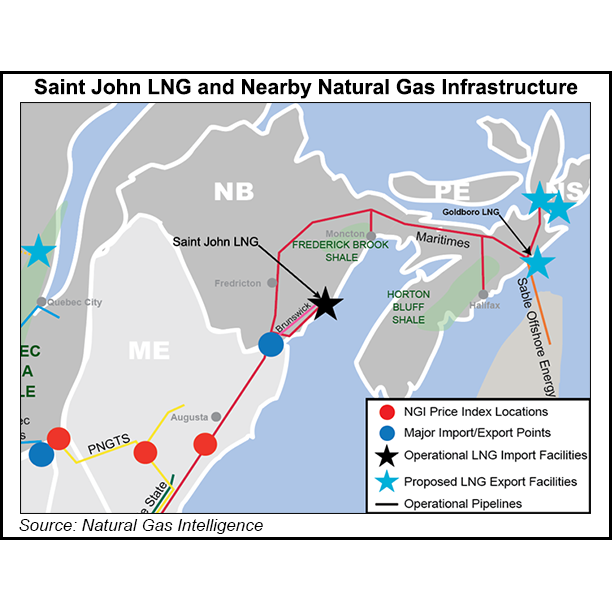

Final 12 months Repsol turned the only real proprietor of the Canaport LNG import terminal at Saint John, New Brunswick. The power has since been renamed Saint John LNG.

5 years earlier in 2016, Repsol and Irving Oil Ltd. had nixed a plan so as to add export functionality on the terminal. Canada’s high power regulator then awarded the previous companions a buying and selling license to permit LNG imports and exports.

In weighing LNG exports from New Brunswick, Alvarez-Pedrosa mentioned “we’re not speaking about changing, however including a brand new facility” on the former Canaport that will have “twin regasification plus a liquefaction unit.”

Citing Europe’s emergence as a sexy LNG vacation spot with the lack of Russian gasoline flows, he mentioned a twin regasification/liquefaction facility “in all probability is sensible.” Nevertheless, varied components, reminiscent of an LNG offtake settlement on the order of 15-20 years and a toll framework that will guarantee Western Canada gasoline was aggressive, would should be in place.

“I’m speaking of issues that aren’t in our arms,” Alvarez-Pedrosa mentioned. “However, it may very well be…attainable within the framework of the power disaster we’re seeing.”

Assist In Canada And Spain

“Through the second quarter, our business confronted a fancy state of affairs that was triggered by modifications within the geopolitical context, racing power costs, and rising issues on the safety of provide,” mentioned CEO Josu Jon Imaz.

Authorities officers on either side of the Atlantic have noticed that the potential challenge may assist to ease Europe’s power safety woes.

In a joint assertion in the course of the latest North Atlantic Treaty Group (NATO) summit in Madrid, the Canadian and Spanish governments expressed unity in selling “short- and long-term strategic pursuits” concerning power safety and environmental sustainability.

“Particularly, we be aware the potential of Repsol’s…facility in Saint John, New Brunswick, to ultimately export LNG to Europe,” in accordance with the assertion in late June by Canadian Prime Minister Justin Trudeau’s workplace. “Spain’s LNG regasification vegetation might present wanted capability to help efforts to scale back European reliance on Russian power.”

New Brunswick’s high elected official advised NGI he wish to see Repsol pursue the Saint John LNG improve.

“I’m absolutely supportive of this challenge,” Premier Blaine Higgs mentioned. Repsol “is in an excellent place” so as to add infrastructure at Saint John to provide the European market. Higgs mentioned LNG export functionality may very well be supplied in about one-half of the estimated six to 10 years it could take to get hydrogen manufacturing amenities for the area up and operating.

“I feel there’s extra of an curiosity proper now to guard our power future,” mentioned Higgs, referencing gasoline provide challenges amongst NATO member international locations.

Throughout 2Q2022 Repsol reported complete international gasoline manufacturing of two.025 Bcf/d, up 12 months/12 months from 1.98 Bcf/d. The common 2Q2022 realized gasoline worth was $7.40/Mcf, in contrast with $3.70 within the year-ago interval.

Liquids manufacturing totaled 180,000 b/d in 2Q2022, down 12 months/12 months from 208,000 b/d. The common crude oil realized worth for 2Q2022 was $102.60/bbl from $61.50 in 2Q2021.

Second quarter web revenue for Repsol, which reviews in euros (1 euro = $1.03), was 1.15 billion euros (79 euro cents/share), or $1.19 billion/82 cents, from year-ago earnings of 587 million euros (39 euro cents), or $606.7 million/40 cents.