Repsol Eyeing 300 MMcf/d in LNG Exports from New Brunswick in Up to date Software

A gap regulatory transfer has been made towards constructing a Canadian LNG export terminal on the east coast by the New Brunswick arm of Spain’s Repsol SA, however pure fuel deliveries are years away.

The plan by Saint John LNG Improvement Co. (SJLNG) goals for preliminary exports of 300 MMcf/d, or solely 40% of the focused volumes that had been in a earlier model of the challenge, in keeping with an utility filed Wednesday to the Canada Power Regulator (CER).

No determination has been made to construct the proposed addition on the present import terminal on the New Brunswick coast, the CER submitting famous. Approval would solely enable additional time to develop the export challenge.

SJLNG is in search of to increase its export license to start deliveries round Could 2032. The terminal addition would enable planning, regulatory approval and building levels, the appliance famous.

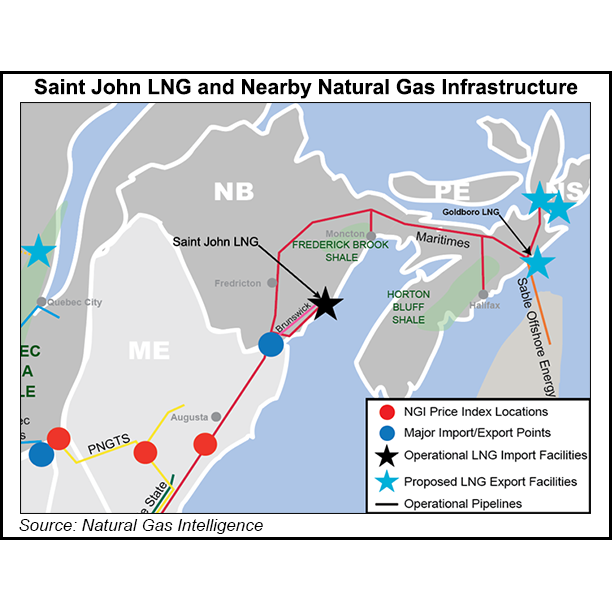

The chief export challenge hurdle could be securing provides, SJLNG famous. A large hole within the Canadian pipeline grid would require roundabout deliveries from western Quebec throughout the japanese United States and north to New Brunswick.

No pipeline from the nation’s essential oil and fuel provinces, Alberta and British Columbia, reaches the Atlantic seaboard. An SJLNG export terminal would import japanese U.S. or Western Canadian-sourced fuel through Maritimes & Northeast Pipeline (MNE).

There was solely minor manufacturing from Atlantic Canada since offshore platforms closed in 2018, with small heating season flows from legacy land wells.

SJLNG’s submitting mentioned “quite a few facets of the proposed enlargement stay unsure and the timeline for first pure fuel imports and liquefied pure fuel exports is at present unknown…

“Even with an aggressive timeline, it will take a minimal of three years for the mandatory approvals to be obtained and the services constructed.”

The scaled-down model of SJLNG’s export plan would additionally expend all the provision capability that could possibly be squeezed into the pipelines with out excessively costly service additions, it famous.

“Whereas the liquefaction functionality of the LNG facility could possibly be additional expanded sooner or later, any such extra enlargement is completely depending on the long run availability of present pipeline capability, as additional enlargement of the interconnecting pipelines is price prohibitive.”

In its authentic function as an import terminal to maneuver fuel to the northeastern United States, 13-year-old SJLNG was stranded by speedy improvement of a lot less expensive unconventional fuel provides.

Repsol wrote off $1.3 billion of the terminal’s worth in 2013. Shell plc additionally excluded the New Brunswick property from a $4.4 billion buy of different Repsol international LNG property.

Gasoline site visitors by SJLNG as an import terminal stays low, CER commerce data point out. In 2021 flows averaged 67.6 MMcf/d, or lower than 7% of the positioning capability for 1 Bcf/d.