This is Why adidas (ETR:ADS) Has A Significant Debt Burden

The exterior fund supervisor backed by Berkshire Hathaway’s Charlie Munger, Li Lu, makes no bones about it when he says ‘The largest funding threat is just not the volatility of costs, however whether or not you’ll endure a everlasting lack of capital.’ It is solely pure to think about an organization’s stability sheet once you look at how dangerous it’s, since debt is usually concerned when a enterprise collapses. Importantly, adidas AG (ETR:ADS) does carry debt. However the extra essential query is: how a lot threat is that debt creating?

Why Does Debt Convey Danger?

Usually talking, debt solely turns into an actual drawback when an organization cannot simply pay it off, both by elevating capital or with its personal money move. Within the worst case situation, an organization can go bankrupt if it can’t pay its collectors. Nonetheless, a extra frequent (however nonetheless pricey) incidence is the place an organization should subject shares at bargain-basement costs, completely diluting shareholders, simply to shore up its stability sheet. In fact, debt could be an essential instrument in companies, significantly capital heavy companies. Step one when contemplating an organization’s debt ranges is to think about its money and debt collectively.

Our evaluation signifies that ADS is doubtlessly overvalued!

How A lot Debt Does adidas Carry?

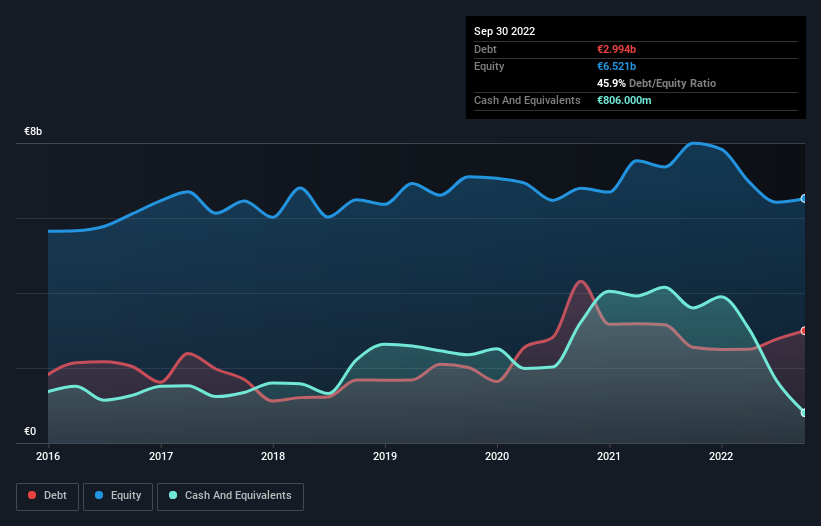

You may click on the graphic under for the historic numbers, but it surely reveals that as of September 2022 adidas had €2.99b of debt, a rise on €2.55b, over one yr. Nonetheless, it additionally had €806.0m in money, and so its web debt is €2.19b.

How Wholesome Is adidas’ Steadiness Sheet?

We are able to see from the newest stability sheet that adidas had liabilities of €10.6b falling due inside a yr, and liabilities of €4.62b due past that. Offsetting these obligations, it had money of €806.0m in addition to receivables valued at €3.35b due inside 12 months. So its liabilities complete €11.1b greater than the mix of its money and short-term receivables.

Whereas this would possibly seem to be quite a bit, it’s not so unhealthy since adidas has a big market capitalization of €21.3b, and so it may in all probability strengthen its stability sheet by elevating capital if it wanted to. Nevertheless it’s clear that we must always positively carefully look at whether or not it may well handle its debt with out dilution.

We measure an organization’s debt load relative to its earnings energy by taking a look at its web debt divided by its earnings earlier than curiosity, tax, depreciation, and amortization (EBITDA) and by calculating how simply its earnings earlier than curiosity and tax (EBIT) cowl its curiosity expense (curiosity cowl). The benefit of this strategy is that we bear in mind each absolutely the quantum of debt (with web debt to EBITDA) and the precise curiosity bills related to that debt (with its curiosity cowl ratio).

Whereas adidas’s low debt to EBITDA ratio of 1.1 suggests solely modest use of debt, the truth that EBIT solely lined the curiosity expense by 5.7 occasions final yr does give us pause. So we would advocate protecting an in depth eye on the affect financing prices are having on the enterprise. Importantly, adidas’s EBIT fell a jaw-dropping 32% within the final twelve months. If that decline continues then paying off debt might be tougher than promoting foie gras at a vegan conference. There is not any doubt that we be taught most about debt from the stability sheet. However it’s future earnings, greater than something, that may decide adidas’s capacity to take care of a wholesome stability sheet going ahead. So in case you’re centered on the long run you’ll be able to take a look at this free report displaying analyst revenue forecasts.

However our ultimate consideration can also be essential, as a result of an organization can’t pay debt with paper earnings; it wants chilly onerous money. So the logical step is to take a look at the proportion of that EBIT that’s matched by precise free money move. Over the past three years, adidas recorded free money move price a fulsome 100% of its EBIT, which is stronger than we would normally anticipate. That positions it nicely to pay down debt if fascinating to take action.

Our View

Neither adidas’s capacity to develop its EBIT nor its stage of complete liabilities gave us confidence in its capacity to tackle extra debt. However the excellent news is it appears to have the ability to convert EBIT to free money move with ease. Taking a look at all of the angles talked about above, it does appear to us that adidas is a considerably dangerous funding because of its debt. That is not essentially a foul factor, since leverage can enhance returns on fairness, however it’s one thing to concentrate on. When analysing debt ranges, the stability sheet is the apparent place to start out. However finally, each firm can comprise dangers that exist outdoors of the stability sheet. We have recognized 3 warning indicators with adidas , and understanding them ought to be a part of your funding course of.

In fact, in case you’re the kind of investor who prefers shopping for shares with out the burden of debt, then do not hesitate to find our unique checklist of web money progress shares, immediately.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not adidas is doubtlessly over or undervalued by testing our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We intention to carry you long-term centered evaluation pushed by elementary information. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.